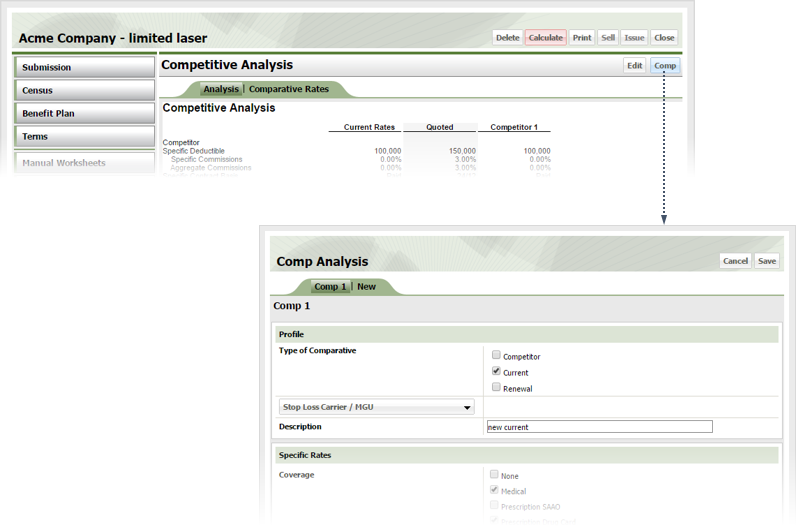

Create a Competitive Analysis

You cannot create a competitive analysis on issued or sold scenarios.

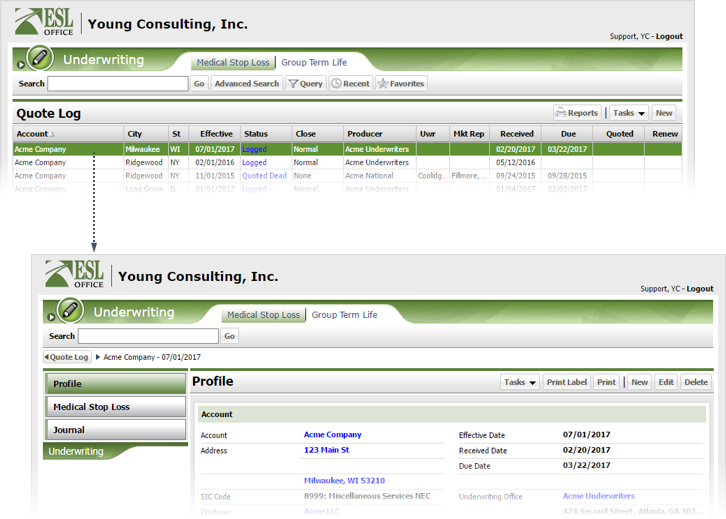

Search the desired medical stop loss quote.

Click the desired quote to display its profile.

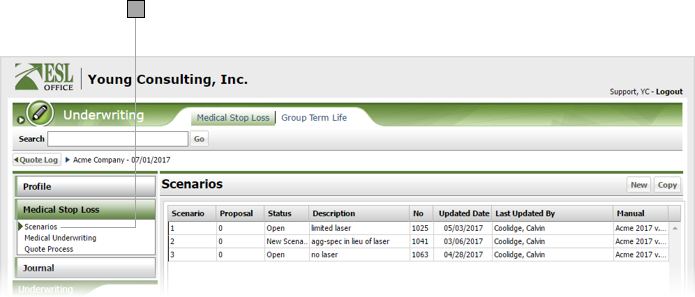

Click the Medical Stop Loss button to display the quote scenarios.

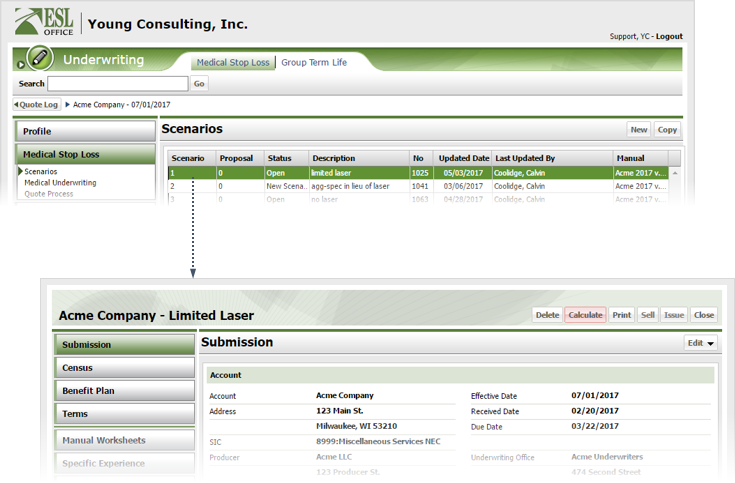

Click the desired scenario to display its scenario page.

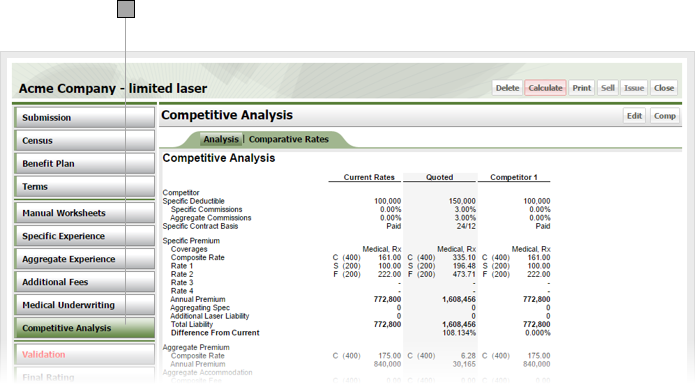

Click Competitive Analysis.

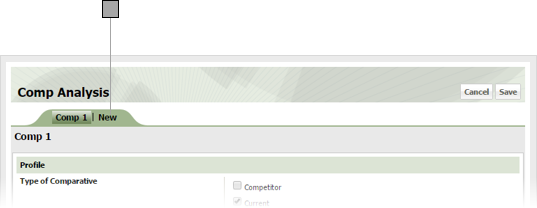

Click Comp to display the Comp Analysis window.

Create the comparison profile as follows

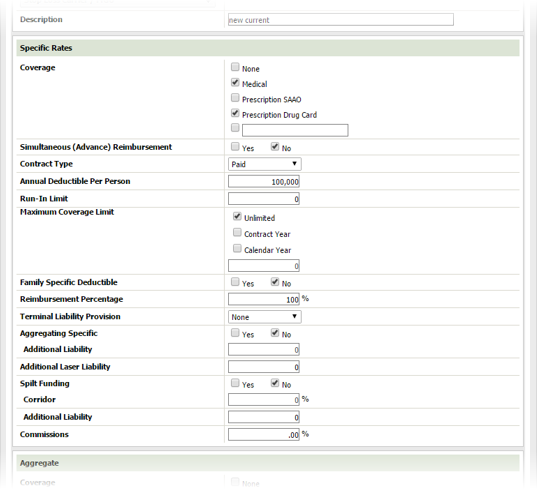

If the comparison includes specific coverage, specify coverage details as follows

Check the box by each type of specific coverage offered. If the specific coverage is not listed, check the last box and manually enter the specific coverage type in the field.

Check Yes if simultaneous reimbursement is allowed. Otherwise check No.

Specify the type of contract using this drop-down list.

Per person annual deductible amount goes here.

Put the run in limit amount here.

Specify the maximum coverage limit by checking the corresponding box as follows

There is no maximum coverage limit.

Maximum coverage limit is tracked by contract year. If you check this box, enter the coverage limit amount in the field below the check boxes.

Maximum coverage limit is tracked by calendar year. If you check this box, enter the coverage limit amount in the field below the check boxes.

Check Yes if deductible is family specific. Otherwise check No.

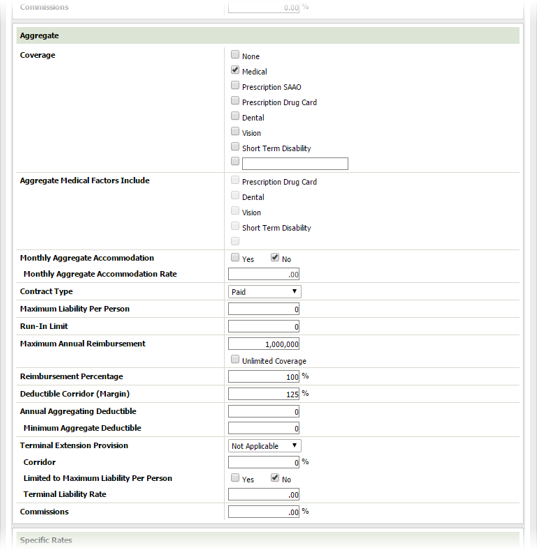

Enter the reimbursement percentage here.

Specify the provision for terminal liability from the drop-down list.

If aggregating specific, check Yes and enter the amount in the Additional Liability field. Otherwise check No.

If you checked Yes for Aggregating Specific, enter the additional liability amount here.

Enter any additional laser liability here.

Check Yes if split funding is allowed. Otherwise check No.

Enter any corridor percentage here.

Enter any additional liability amount here.

Enter any percent commission amounts here.

If the comparison includes aggregate coverage, specify coverage details as follows

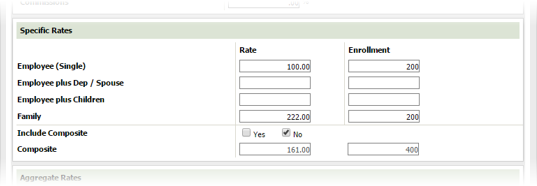

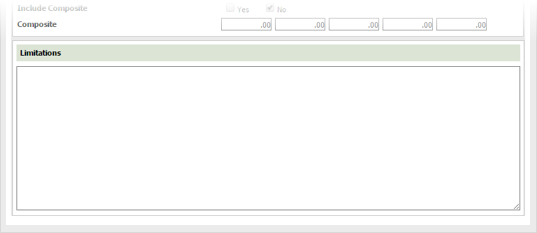

If the comparison includes specific coverage, specify rates and enrollment. If composite is included, check Yes for Include Composite and enter the composite values in the corresponding fields.

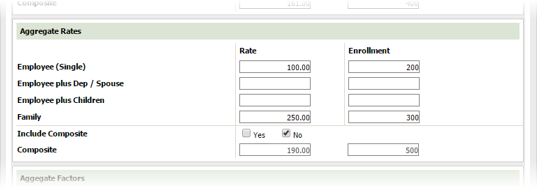

If the comparison includes aggregate coverage, specify rates and enrollment. If composite is included, check Yes for Include Composite and enter the composite values in the corresponding fields.

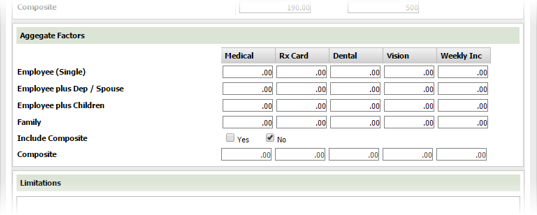

If the comparison includes aggregate coverage, specify aggregate factors. The columns you see here correspond to coverages selected. If composite is included, check Yes for Include Composite and enter the composite factors for each coverage.

Specify any limitations in the Limitations text area.

If you want to add another comparison, click the New tab and document the comparison as described above.

When you are done adding comparisons, click Save to close the Comp Analysis window.

Click Edit on the Competitive Analysis page to display the Competitive Analysis window.

Select the quote option and competing option you want to compare from the drop-down lists, and click Save.